A California initiative --

California Drug Price Relief Act -- would prohibit state agencies from

paying more for prescription drugs than the VA.

Senator Bernie Sanders has thrown his support behind the Act.

The Act could put a dent in prices for prescription drugs like HCV and HIV/AIDS.

If the Act gains traction nationwide it could sink GILD.

Bernie Sanders has gone too far this time.

In September Hillary Clinton put the healthcare industry on notice pursuant to price gouging. She may have been trying to upstage Senator Bernie Sanders after his HCV rant four months earlier. Sanders thought veterans deserved the world's best HCV treatment -- Gilead's (NASDAQ:GILD) Harvoni -- at a reasonable price; I agreed with him. Market chatter suggested the VA garnered HCV drugs at $40,000 per regimen. Gilead intimated it cut the price even further in Q1 in order to woo the VA back.

Sanders may have gone too far this time. He is backing the California Drug Price Relief Act ("CDPRA" or "the Act"), which could allow the state to pay the same price for drugs as the VA:

The Situation

There are certain goods -- prescription drugs, a college education -- that economists would describe as inelastic; when their prices rise demand does not fall. Companies like Turing and Valeant (NYSE:VRX) have purposely acquired certain life-saving or irreplaceable drugs and gouged the public. According to the Act, [i] prescription drug spending is one of the fastest growing segments of healthcare and [ii] spending on special medications, such as those used to treat HIV/AIDS, Hepatitis C, and cancers are rising faster than other types of medications.

California's intent is to pay the same prices for prescription drugs as the VA and rectify the imbalance among government payers. If the initiative is passed it could have the following implications:

Medicare Could Reduce Payouts For HCV

The Wyden-Grassley Report highlighted how Gilead's HCV prices were divorced from the R&D spent to develop Sovaldi and Harvoni. The December 2015 report also divulged that over the previous 18 months Medicare had spent $8 billion (prior to rebates) on HCV drugs. It is my understanding that Medicare is prohibited from negotiating directly with drug manufacturers; if Medicare was automatically granted rates paid by the VA it could potentially cut Medicare payouts, and also drive down prices for Gilead, Abbvie (NYSE:ABBV) and/or Merck (NYSE:MRK).

California Department Of Healthcare Services Could Get Access To HCV At Steep Discounts

The Act would prohibit all California state agencies -- including the California Department of Healthcare Services ("DHCS") -- from entering into contracts to purchase a prescribed drug unless the price is the same or less than that paid by the VA. The DHCS helps millions of disabled and low-income individuals gain access to healthcare, mental health and substance abuse services and treatments. About one-third of Californians receive services through DHCS and it serves over 13 million members.

As California's largest purchaser of health services, it has enormous purchasing power. If it purchased HCV and other drugs at prices garnered by the VA, certain drugs could become within reach of lower-income individuals. Such a program could potentially serve as a model for other states who want to offer access to best-in-class treatments to lower income residents.

There is a perception that Gilead's HCV treatments have reached the sickest individuals and those who can afford to pay. There remains a large percentage of the 3.5 million HCV infecteds that are poor, homeless or incarcerated. The Act could be the catalyst that brings HCV regimens to the masses, but at a steep discount to the headline price of $90,000.

What Next For Gilead?

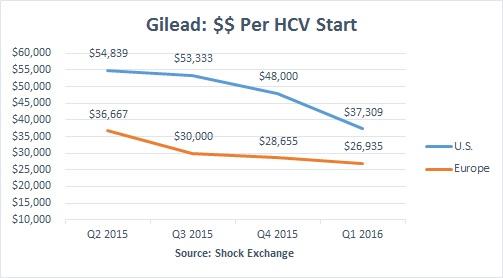

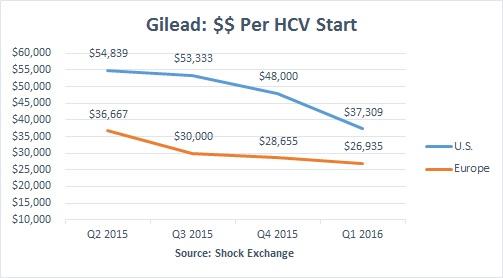

Gilead has been offering discounts based on clients' leverage -- the VA and certain pharmacy benefit managers have gotten better deals due to their buying power. Gilead's Q1 2016 HCV revenue fell 12% Q/Q and it was a huge disappointment. Steep discounts to the VA, a proliferation of patients with lower fibrosis scores and patients with a lower average duration of therapy, and added competition from Merck caused revenue/start to fall.

Revenue per start in the U.S. fell to $37 thousand from $48 thousand in Q4. The CDPRA and the potential price battle with New York health insurers could drive that metric much lower. I had originally assumed that health insurers and potentially Medicare, would attempt to negotiate HCV prices at some number between [i] what the general public paid and [ii] what the VA paid. If Senator Sanders has his way, California state agencies -- and potentially others -- will get the full VA discount. The CDPRA will be voted on in November and if it passes, it could sink GILD.

Senator Sanders has gone too far this time, at least that is what I'm betting on. I have initiated a short position in GILD. I believe the Act, and its implications, could create an overhang for the stock. I will likely remain short until the Act has been resolved.

Senator Bernie Sanders has thrown his support behind the Act.

The Act could put a dent in prices for prescription drugs like HCV and HIV/AIDS.

If the Act gains traction nationwide it could sink GILD.

Bernie Sanders has gone too far this time.

In September Hillary Clinton put the healthcare industry on notice pursuant to price gouging. She may have been trying to upstage Senator Bernie Sanders after his HCV rant four months earlier. Sanders thought veterans deserved the world's best HCV treatment -- Gilead's (NASDAQ:GILD) Harvoni -- at a reasonable price; I agreed with him. Market chatter suggested the VA garnered HCV drugs at $40,000 per regimen. Gilead intimated it cut the price even further in Q1 in order to woo the VA back.

Sanders may have gone too far this time. He is backing the California Drug Price Relief Act ("CDPRA" or "the Act"), which could allow the state to pay the same price for drugs as the VA:

Now he [Sanders] is throwing his support behind a California ballot initiative that is being furiously opposed by drug makers who fear the proposal to limit drug prices, if passed, could spark a national movement. The California Drug Price Relief Act, which will be voted on in November, would prohibit the state from paying more for a prescription drug than the lowest price paid for the same drug by the U.S. Department of Veterans Affairs. The department has the power to negotiate lower prices for medications ...

One Republican drug lobbyist, speaking anonymously, told Politico the initiative was "a grenade being rolled into the conversation," and is being taken very seriously by the industry.According to Politico the drug industry has set aside $100 million to fight the initiative, fearing it could set precedent. However, if the initiative gains traction it could put a serious dent in prescription drug prices.

The Situation

There are certain goods -- prescription drugs, a college education -- that economists would describe as inelastic; when their prices rise demand does not fall. Companies like Turing and Valeant (NYSE:VRX) have purposely acquired certain life-saving or irreplaceable drugs and gouged the public. According to the Act, [i] prescription drug spending is one of the fastest growing segments of healthcare and [ii] spending on special medications, such as those used to treat HIV/AIDS, Hepatitis C, and cancers are rising faster than other types of medications.

California's intent is to pay the same prices for prescription drugs as the VA and rectify the imbalance among government payers. If the initiative is passed it could have the following implications:

Medicare Could Reduce Payouts For HCV

The Wyden-Grassley Report highlighted how Gilead's HCV prices were divorced from the R&D spent to develop Sovaldi and Harvoni. The December 2015 report also divulged that over the previous 18 months Medicare had spent $8 billion (prior to rebates) on HCV drugs. It is my understanding that Medicare is prohibited from negotiating directly with drug manufacturers; if Medicare was automatically granted rates paid by the VA it could potentially cut Medicare payouts, and also drive down prices for Gilead, Abbvie (NYSE:ABBV) and/or Merck (NYSE:MRK).

California Department Of Healthcare Services Could Get Access To HCV At Steep Discounts

The Act would prohibit all California state agencies -- including the California Department of Healthcare Services ("DHCS") -- from entering into contracts to purchase a prescribed drug unless the price is the same or less than that paid by the VA. The DHCS helps millions of disabled and low-income individuals gain access to healthcare, mental health and substance abuse services and treatments. About one-third of Californians receive services through DHCS and it serves over 13 million members.

As California's largest purchaser of health services, it has enormous purchasing power. If it purchased HCV and other drugs at prices garnered by the VA, certain drugs could become within reach of lower-income individuals. Such a program could potentially serve as a model for other states who want to offer access to best-in-class treatments to lower income residents.

There is a perception that Gilead's HCV treatments have reached the sickest individuals and those who can afford to pay. There remains a large percentage of the 3.5 million HCV infecteds that are poor, homeless or incarcerated. The Act could be the catalyst that brings HCV regimens to the masses, but at a steep discount to the headline price of $90,000.

What Next For Gilead?

Gilead has been offering discounts based on clients' leverage -- the VA and certain pharmacy benefit managers have gotten better deals due to their buying power. Gilead's Q1 2016 HCV revenue fell 12% Q/Q and it was a huge disappointment. Steep discounts to the VA, a proliferation of patients with lower fibrosis scores and patients with a lower average duration of therapy, and added competition from Merck caused revenue/start to fall.

Revenue per start in the U.S. fell to $37 thousand from $48 thousand in Q4. The CDPRA and the potential price battle with New York health insurers could drive that metric much lower. I had originally assumed that health insurers and potentially Medicare, would attempt to negotiate HCV prices at some number between [i] what the general public paid and [ii] what the VA paid. If Senator Sanders has his way, California state agencies -- and potentially others -- will get the full VA discount. The CDPRA will be voted on in November and if it passes, it could sink GILD.

Senator Sanders has gone too far this time, at least that is what I'm betting on. I have initiated a short position in GILD. I believe the Act, and its implications, could create an overhang for the stock. I will likely remain short until the Act has been resolved.

Disclosure: I am/we are short GILD, VRX.

I wrote this

article myself, and it expresses my own opinions. I am not receiving

compensation for it. I have no business relationship with any company

whose stock is mentioned in this article.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.